July 13, 2025

| Welcome Welcome Welcome NUMERA BOOKS

- kenia@numerabooks.biz

- (980) 920-5917

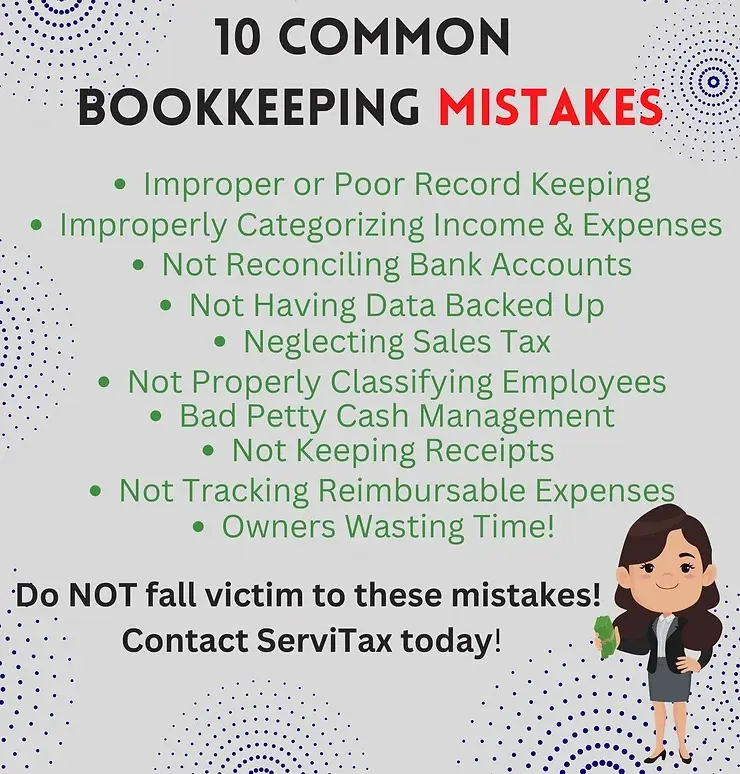

10 Common Bookkeeping Mistake

Bookkeeping is required for any successful business regardless of the size or industry.

So, if you are a business owner and have decided to DIY your bookkeeping here are some common mistakes for you to avoid. Our team at ServiTax has created a Printable list below and I have added some expanded explanations for the mistakes I feel need to explain themselves.

Improperly Categorizing Income & Expenses

This common mistake can cost your business dearly if not caught before filing your taxes. Not all deposits are income and not all charges are expenses. In Example, let’s say you own a construction company and you like to shop for materials at Lowes. Your purchase totaled $150 but you ended up not using all the materials, so you return the leftovers to the store in the amount of $50. How do you record that in the books? The common mistake is posting the $50 as income because it shows as a deposit in the bank account.

The correct way to record this situation would be to cost the original charge to its expense account of Job Materials $150 and the refund deposit of $50 to the same expense account the original charge was sent to. In this case the Job Materials account. I use this saying as a reminder “Return the money from where it left” not too clever but it gets the job done.

Tip: To ensure that you do not categorize your expenses incorrectly make sure to review a detailed Profit & Loss Report and make sure all expenses are where they need to be or look at the general ledger

Not Reconciling Bank Accounts

It’s in the name bookkeeping, but surprisingly enough the most common mistake I see at the end of the year is the case of Incomplete books. Meaning the person responsible for the books has not entered all transactions or reconciled bank accounts to the end of the year. This produces incorrect Financial Reports and therefore incorrect Tax Returns.

Neglecting Sales Tax

Whether your providing goods or services locally or online you must keep track, in some cases charge and pay Sales Taxes. Keep in mind that Sales Tax laws vary for certain things like Service from State to State but what all 50 US States agree on is that sales tax needs to be charged for goods, recorded an paid within the guidelines of the Nexus if you are an e-commerce business. If you do not have a method of tracking sales and location of where your goods are being purchased you may find your business audited by your state’s Department of Revenue. All businesses pay Taxes, but why pay penalties and Interest just because you neglected to collect or report sales tax.

Receipts, Receipts, Receipts

I know you have heard this before but receipts are really that important. Make sure to always properly store and record your receipts. Luckily nowadays technology can make this task easier, if you have Quickbooks online you can use the mobile app on your phone to digitally store your receipts. There are more app integrations to QBO for the proposes of receipt storage so feel free to ask your nearest Quickbooks ProAdvisor.

Useful Link

Navigation

Importance of accurate and timely financial information for the success of your business.